Whether you’re a TAMP, an Asset Manager, or an RIA Aggregator looking to secure more direct advisor relationships, BridgeFT has the solution to meet your servicing and investment product distribution needs.

At BridgeFT, we help TAMPs and RIA Aggregators overcome their most common challenges. Experience limitless potential when powered by our WealthTech API.

New, or established, TAMPs looking to scale, expand available functionality, and/or create a truly one-of-a-kind custom experience.

RIAs with a growing asset management arm – seeking alternatives to traditional channels to support the distribution of their investment products (SMAs, ETFs, alt strategies, etc.). A modern technology stack allows you to stand out in a crowded market, and deliver curated strategies directly to your target audience.

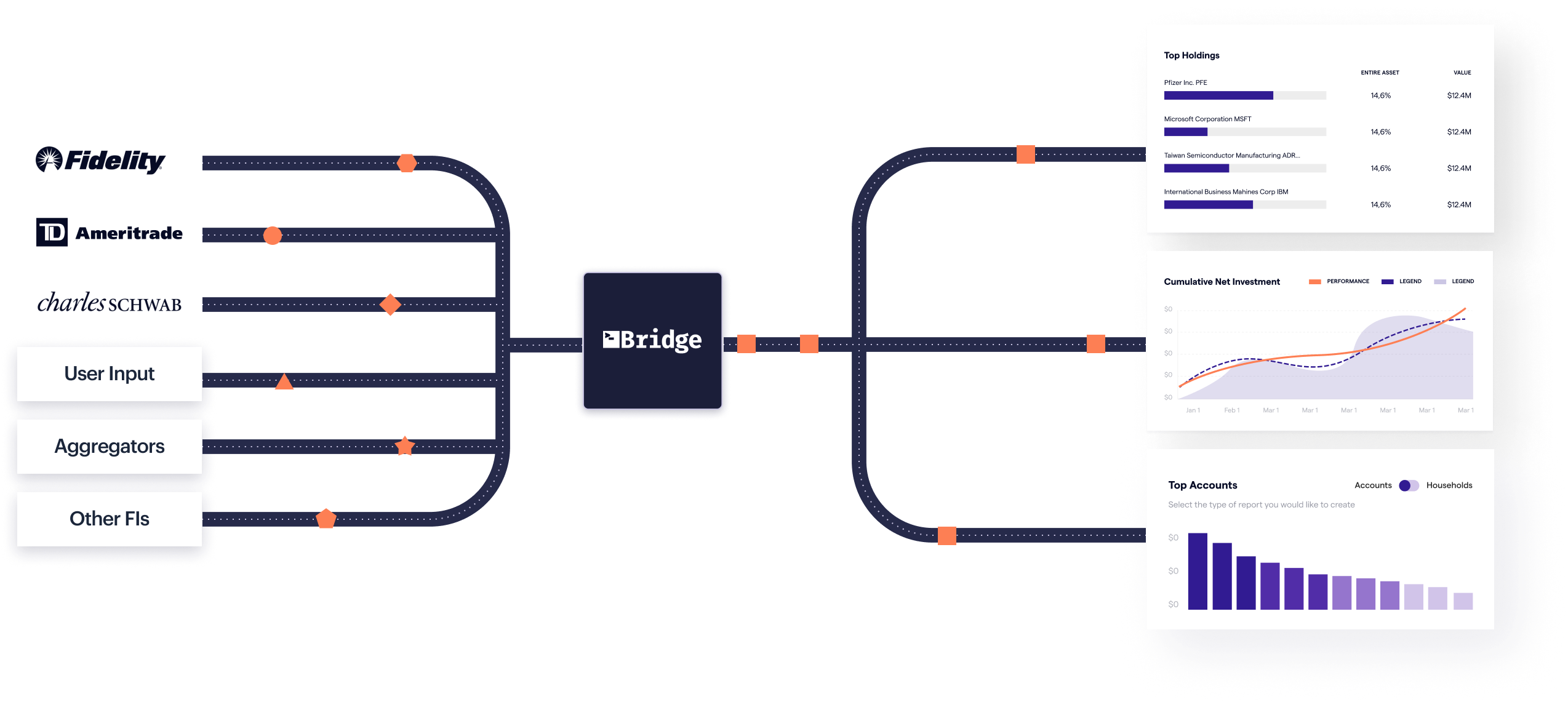

Asset Managers seeking new, direct distribution channels that bring them closer to the advisor-client relationship. From data connectivity to all of the major custodians and UMA model creation/management to robust reporting and billing, BridgeFT is a strategic partner that can power the wealth infrastructure needed to deliver unique tools and essential data to drive growth.

Growth-focused RIAs offering rollup, breakaway, IAR, and/or DBA opportunities for independents looking for tech, operations, compliance, and investments support. BridgeFT offers a modern framework on which to build a wealth management technology stack that delivers long-term scalability and service flexibility.

BridgeFT WealthTech API eliminates the most common data challenges organizations face.

Meet with a product specialist to learn more about how WealthTech API can help you achieve your goals.

Explore

Social