Regardless of what stage your business is at, BridgeFT makes running and growing it easier and more profitable.

With our Atlas software, financial advisors get a suite of benefits to boost their firm’s success for one price.

Let us automate manual, repetitive tasks like daily reconciliation, cash reviews, report creation and delivery, and more. Grow faster by leveraging modern automation.

You don’t have to trade compliance for speed. Eliminate risks from manual data entry, inconsistent reporting practices, and spreadsheet-driven billing processes.

Every new growth milestone shouldn’t bring new software fees with it. Improve your margins as you scale with fair pricing that rewards growth.

Stop spending more time with your software than with your clients. Our capabilities give you the tools to deepen client relationships, and our speed gives you the time to do so.

No matter where client data is coming from, BridgeFT has you covered. Constantly double checking data and performance from your legacy vendor? There’s a better way. Still doing recon yourself? Let us automate it.

In need of a dedicated data solution? Learn more.

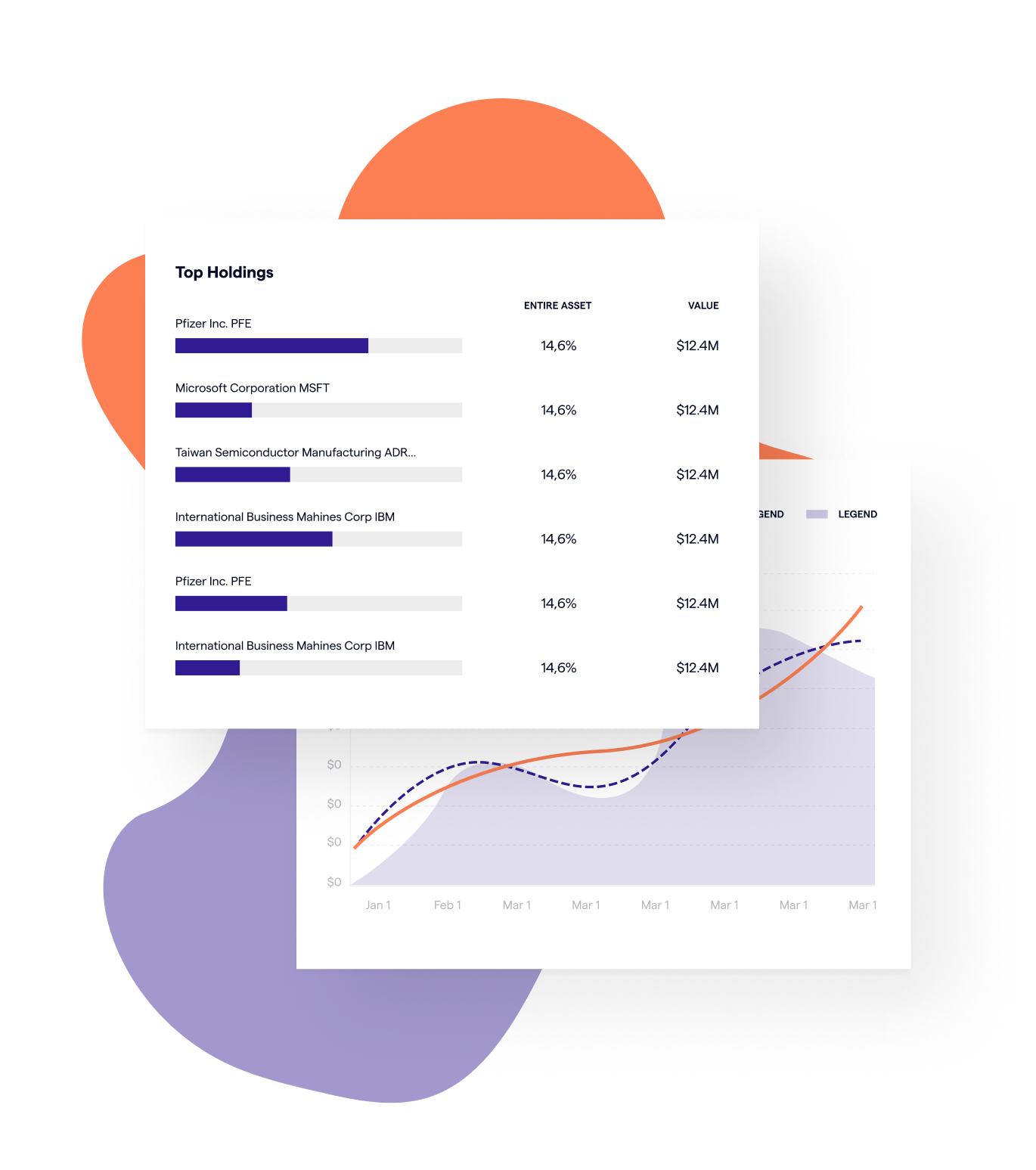

Client reporting shouldn’t feel like a chore—for you or your clients. Look forward to client meetings again and grow client confidence with Atlas’ clear, modern, and concise reporting capabilities.

Access our suite of client reports through an interactive web-portal or print white-labeled reports for in-person review.

Stop waiting for days––or weeks––to process fees. Finish monthly and quarterly billing in minutes, including automatic, compliant invoice generation and delivery.

Stay up to date with accounts, know where to spend time, and how to best inform your client relationships. The Atlas Insights Engine makes life easier, delivering proactive client insights so advisors can prioritize client management and communication with confidence.

Enabling the advisor to automate report delivery to clients in a secure, compliant way. Directly clients information from the system, including reporting and billing.

Provide transparency and access for clients to review their accounts at any time. Customize what you share and white label your firm’s branding to match your approach to client communication.

Manage in-house and/or 3rd party investment strategies with efficiency, compliance, and confidence. Capabilities cover everything from simple ETF strategies to the most complicated multi-strategy UMAs. Integrate and sync investments directly with your Trade Order Management System.

Leverage best in class aggregators vetted by Bridge and integrated natively to Atlas, or bring your own.

Quickly identify operational inefficiencies, risks, and opportunities; understand and project revenues and more.

Bridge doesn’t end integrations at SSO, that’s just the beginning. Access industry leading connectivity.

Scale rollup or aggregation strategy faster, and with greater control over the advisor experience. Manage sub-firms and advisor access with unparalleled flexibility

No data feed? No problem. Report and bill on non-marketable and illiquid assets. Everything from the client’s house to an LP holding in a hedge fund.

Put the firm’s brand first with whitelabeling that enables a coherent, branded client experience from site to reports and portals.

Robust performance measurement methods that can support the firm’s business from inception to scale. Our tech and team are no strangers to GIPS Compliance and Verification support.

Account maintenance shouldn’t be stressful, even at scale. Monitor and update client and portfolio management data with ease. Take action and make updates quickly, whether you manage 100s of accounts or 1000s.

Unique business models sometimes require unique solutions. Bridge can still help deliver, even if your needs go beyond the our current capabilities. Leverage our powerful data platform to build custom apps, integrations, or plugins.

It is your data and you own it – we just turn it into attractive, easy-to-understand reports for your clients and your firm. We never sell or share your data with any third party unless you expressly request we do so (for example, an integration out to another technology provider), and we never will. We also take information security very seriously.

Absolutely! We have a few options with various technology and investment management partners – it all depends on how much (or how little) involvement you want on a day-to-day basis in this part of your business.

Contact BridgeFT Sales to learn about these option and discuss the most suitable for you and your clients.

We offer the necessary customizations for billing and reporting without overwhelming you with choices. Examples of customizations include: benchmark creation, asset classification names, and reporting type and frequency. For clients who demand complete control, you have full customization ability through our API with a number of ecosystem partners ready to help you.

Of course. You can customize the logos and disclosures on your reports, invoices, and client portal.

This is completely up to you, the advisor/firm owner – we do not send communications from the Bridge system to your clients, but we do offer you the option to invite some or all of your clients to view reports and invoices, aggregate outside accounts, and share files via your white-labeled client portal.

Yes – we work with all firms regardless of size or number of accounts. It just depends on what your clients want to see on their reports and what will help you drive client conversation. Drop our Sales Team a line and they can quickly help you determine if Atlas is the right tech for you.

Not a problem! Depending on the source of data for your the alternative assets you want tracked, our team can develop a custom data and reporting solution for your firm. We recommend discussing your needs with a member of our team so we can help you evaluate the options available.

Our standard onboarding takes less than 30 days from signing the contract with Bridge to having access to the system. During this time, we manage the historical data conversion, your billing configuration, and any customizations from your former system, so you can focus on your business priorities. Please note that due to significant demand, your onboarding time-frame may be subject to a waitlist.

Our tool is designed to be simple and easy to use. To keep it that way, we have limited excessive customizations, settings, and workflows you need to create at the time of onboarding. Additionally, Bridge has proprietary automation technology built around typical conversion processes. These together both reduces onboarding time and the learning curve for leveraging our technology

Learn more about Atlas for Advisors by scheduling a demo today

Discover powerful back-office advisor technology with seamless custodial data flow.

Meet with a product specialist to learn more about how WealthTech API can help you achieve your goals.

Explore

Social