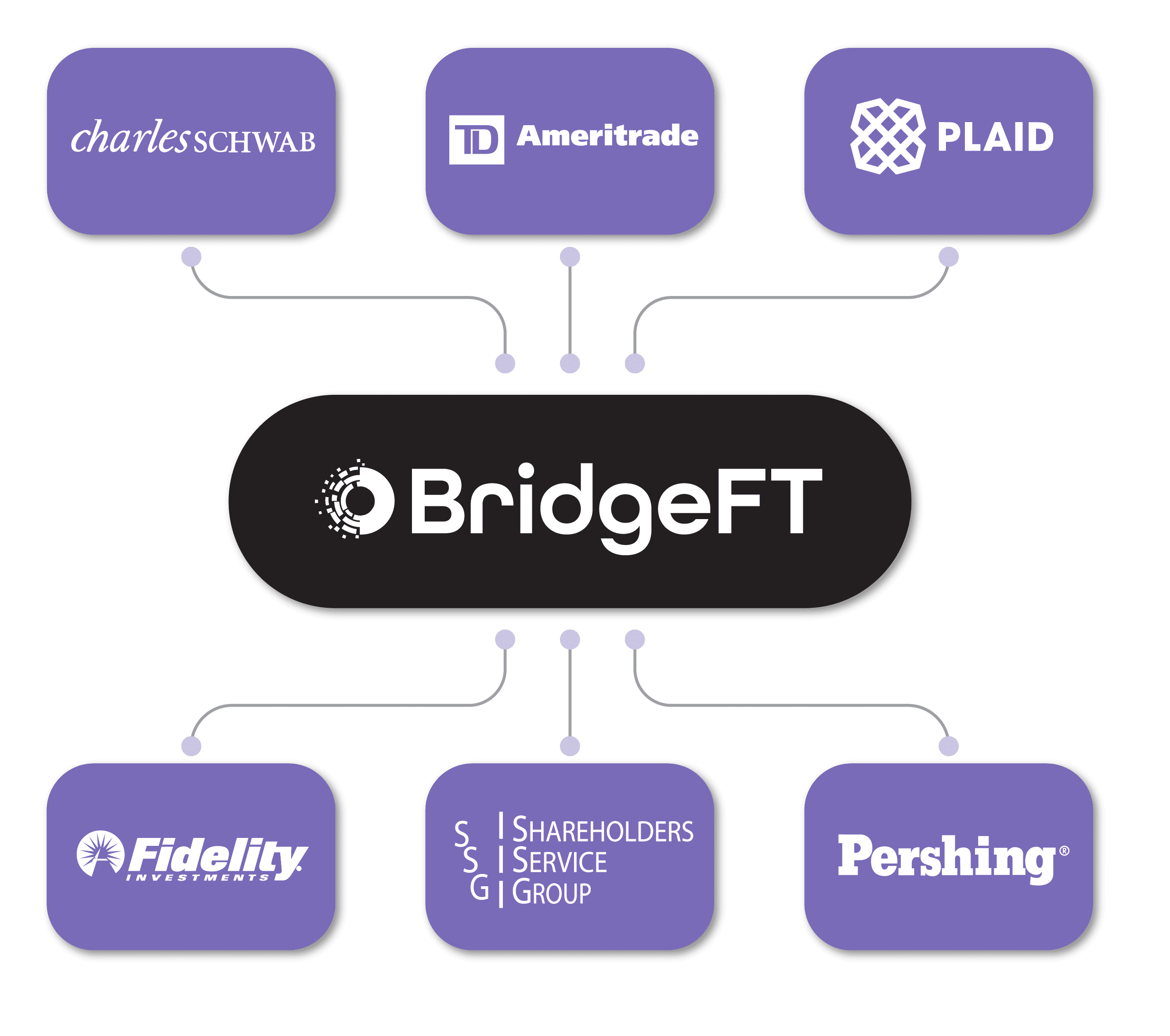

By tapping into our ecosystem, you can take advantage of BridgeFT’s robust partner network of wealth technology and services.

BridgeFT is always on the hunt for innovative, tech-forward advisor solutions.

Get in touch with us to learn more about joining our ecosystem.

Modern wealth management success hinges on technology. At BridgeFT, we believe our open architecture and vast network of partners create an ecosystem designed to help firms excel.

Easily integrate BridgeFT into your existing technology stack and use it alongside the tools your team and clients already love.

Leverage BridgeFT as the central source for client data, performance, and insights. Help your advisors stay in-sync across portals, offices, and states.

Choose from our robust network of integrations that go beyond single-sign on. Build a connected tech stack that helps run a more efficient firm.

We integrate with many of the leading financial institutions, technologies, and services. Click the categories to learn more about our partners.

TD Ameritrade is an online brokerage firm that allows you to easily trade and invest in stocks, bonds, and other securities.

Charles Schwab is a full-service investment firm that offers banking, brokerage, and advisory services to help you grow and manage your wealth.

Fidelity Investments is a financial services provider that offers investment management, retirement planning, and wealth management solutions to help you achieve your financial goals.

Pershing Advisor Solutions is a global provider of clearing, settlement, and custody solutions for financial organizations, helping them streamline their operations and provide better service to their clients.

Apex Clearing is a full-service clearing and custodial platform for broker-dealers and investment advisors, providing them with the tools and services they need to manage their clients’ assets effectively.

DST Systems is a provider of technology, data processing, and servicing solutions to the financial services industry, helping companies improve their efficiency and effectiveness.

Interactive Brokers is an online discount brokerage that offers trading in stocks, options, futures, forex, bonds, and funds, providing investors with access to a wide range of investment opportunities.

Plaid is a financial technology company that offers a platform for connecting bank accounts to applications and services, making it easier for you to manage your finances.

Shareholders Service Group is a technology-driven custodian and brokerage platform that offers registered investment advisors an efficient and easy way to manage their clients’ investments.

Millenium Trust Company is an IRA custodian and alternative asset custody provider that offers a wide range of investment options to help you build a diversified portfolio.

TIAA is a financial services company that offers retirement planning, investment management, and banking services to help you achieve financial security and peace of mind.

Income Lab provides financial advisors with cutting-edge software for ongoing retirement income management and client engagement.

Money Guide is a financial planning software for advisors to create and track client financial plans.

Right Capital is a financial planning and investment management software for advisors to help clients achieve their financial goals.

BridgeFT is always on the hunt for innovative, tech-forward advisor solutions.

Get in touch with us to learn more about joining our ecosystem.

Tolerisk is a risk management software for financial advisors to help them assess and mitigate portfolio risks.

Stratifi is a portfolio analytics and management software for investment advisors to help them make informed investment decisions.

SmartRIA is a compliance software for registered investment advisors to help them manage their regulatory obligations.

RIA Compliance Consultants is a consulting firm that helps investment advisors comply with regulatory requirements.

Synergy RIA Compliance is a compliance consulting firm that helps investment advisors manage regulatory risks and stay compliant.

Blaze Portfolio is a portfolio rebalancing and management software for investment advisors to help them automate their portfolio management process.

Wealthbox is a CRM software for financial advisors to manage their client relationships and workflows.

Salesforce is a cloud-based CRM software that provides a range of business solutions, including financial services.

ForwardLane is an AI-powered wealth management platform for financial advisors to help them deliver personalized investment advice to their clients.

VRGL is a technology-enabled investment management firm that offers risk-managed investment solutions to financial advisors and institutions.

Portformer is a portfolio analytics and reporting software for investment advisors to help them make better investment decisions.

ALLINDEX is an investment research and analytics firm that provides investment advisors with data-driven insights into financial markets.

STP Investment Services is a provider of investment management and administration services for institutional investors and investment advisors.

Eaglebrook Advisors is a wealth management firm that offers investment advice and portfolio management services to high net worth individuals and families.

Meet with a product specialist to learn more about how WealthTech API can help you achieve your goals.

Explore

Social