Rapidly Growing RIA and Wealthtech Platform Provider Creates Differentiated Advisor Experience That Combines Unique Technology and Deep Investment Experience.

Parti Pris Investment Partners is a growing RIA and wealthtech platform. Their team works directly with advisors and advisory companies, providing solutions that help them to personalize and scale individual and household-level portfolios. Their offerings include direct indexing connected to a client’s highly personalized investment objectives, as well as comprehensive tax-aware portfolio management. Their integrated solution aims to simplify the experience for the advisor and give them the necessary tools to drive deeper conversations around portfolio personalization. As such, their need for trade-ready, multicustodial data became evident. Their Co-Founder and Chief Investment Officer, Joe Smith, explained “from a technology perspective, it’s important for us to take the complexity out of the process for how the client’s data gets associated with investment decisions.”

Before working with BridgeFT, their team sought an integration provider that could seamlessly capture client investment data, portfolio accounting, fee billing, and performance reporting as core building blocks to their advisor platform. Parti Pris quickly became interested in BridgeFT’s offering because of the company’s focus on flexible integration options and offering a dedicated API library. Joe explained “other vendors may have been around longer, but with BridgeFT there is such a robust API library to support multi-custodial data integrations—which made it an obvious choice for how we could support our own data model.”

Co-Founder and Chief Investment Officer, Joe Smith, explained “other vendors may have been around longer, but with BridgeFT there is such a robust API library to support multicustodial data integrations—which made it an obvious choice for how we could support our own data model.”

In addition to an API-first approach and best-in-class documentation, Joe’s team also found value in the depth of data provided via BridgeFT’s WealthTech API. “Another factor is that we support the ability to manage around a household. We saw instantly that BridgeFT has a lot of data flow in this area and made it much easier for us to create differentiation around our household approach. With the API, we can manage this as one aggregated personalized portfolio.”

After deciding to deploy the WealthTech API, Parti Pris and BridgeFT’s teams worked together to ensure the deployment was successful. Joe is enthusiastic about the working relationship with BridgeFT. “One thing we love about BridgeFT is the client service and how responsive everyone is when things come up. If we’re trying to do something with the development library, and it’s not working out how we’d envisioned it, the BridgeFT team is so fabulous and responsive about getting engineering folks to discuss use cases then taking it back to figure out a specific solution to address that.”

Joe is enthusiastic about the working relationship with BridgeFT. “One thing we love about BridgeFT is the client service and how responsive everyone is when things come up.”

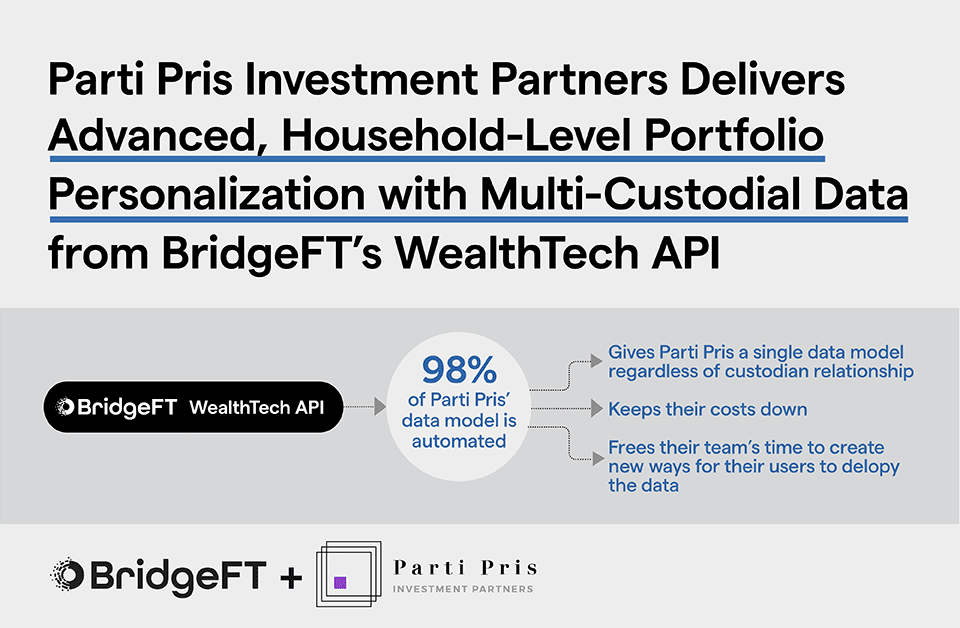

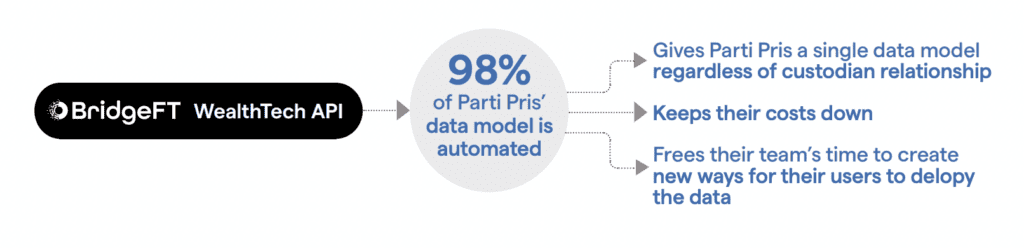

The WealthTech API has allowed the Parti Pris team to achieve an unprecedented level of automation. Joe explained “98% of our data model is now automated and this automation is absolutely key for us. It means we’re not spending time each day identifying what data needs to go where.” The normalized, multi-custodial data from the WealthTech API gives Parti Pris a single data model that makes it extremely efficient to support their mission to help put data into action for advisors—all while keeping costs down. The automated process around data consumption frees up their team’s time to create new and useful ways for their users to deploy that data at their own practices.

Parti Pris is now able to offer more advanced portfolio construction tools, providing a superior client/ investor experience. Joe said “it helps that with the WealthTech API, we can manage each individual account simultaneously—down to each unique client. This makes it very scalable for us to process a lot of accounts and gives more flexibility for the advisor to manage client portfolios.”

With BridgeFT’s WealthTech API now the backbone infrastructure supporting their wealthtech platform, Parti Pris is turning their attention to further opportunities for development. As Joe put it “BridgeFT’s API library makes it really easy to think about our ideal client experience and how additional pieces of functionality could be integrated as part of our platform.

“BridgeFT’s API library makes it really easy to think about our ideal client experience and how additional pieces of functionality could be integrated as part of our platform.”

One big thing we’ve been discussing is creating a seamless integration for client reporting, especially performance reporting.” Their vision is to enable their advisors to develop a personalized portfolio and then continuously receive proactive updates on clients accounts/performance, so they can effectively answer: how has my asset allocation evolved? Joe added “BridgeFT’s WealthTech API makes it a lot easier for us to deliver these types of experiences rather than thinking about the infrastructure required to ingest data, process it, and then display it back to the client.”

“BridgeFT’s WealthTech API makes it a lot easier for us to deliver these types of experiences rather than thinking about the infrastructure required to pick up/ ingest data, process it, and then display it back to the client.”