During Q2 the BridgeFT team focused on expanding the reporting capabilities within our Atlas platform while also launching new integrations powered by our WealthTech API.

New Features Available in BridgeFT Atlas for Advisors

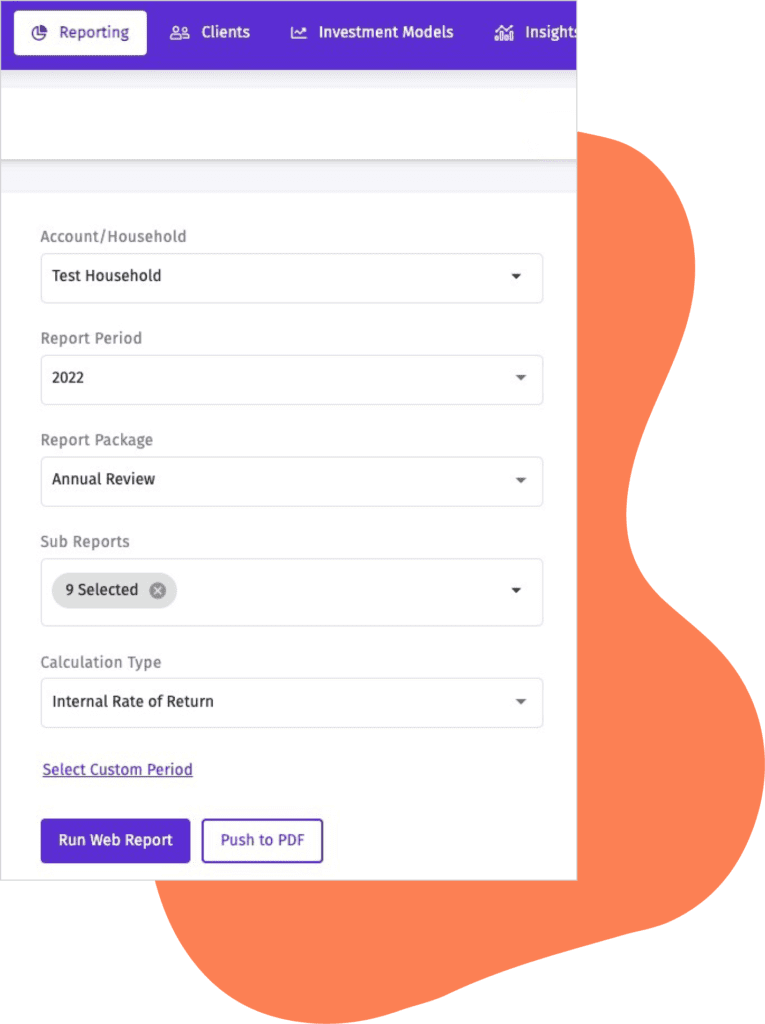

Internal Rate of Return Reports: with just the click of a button, advisors can now generate IRR reports as needed. Users can easily toggle between Time-Weighted Returns (TWR) or IRR for their preferred calculation method.

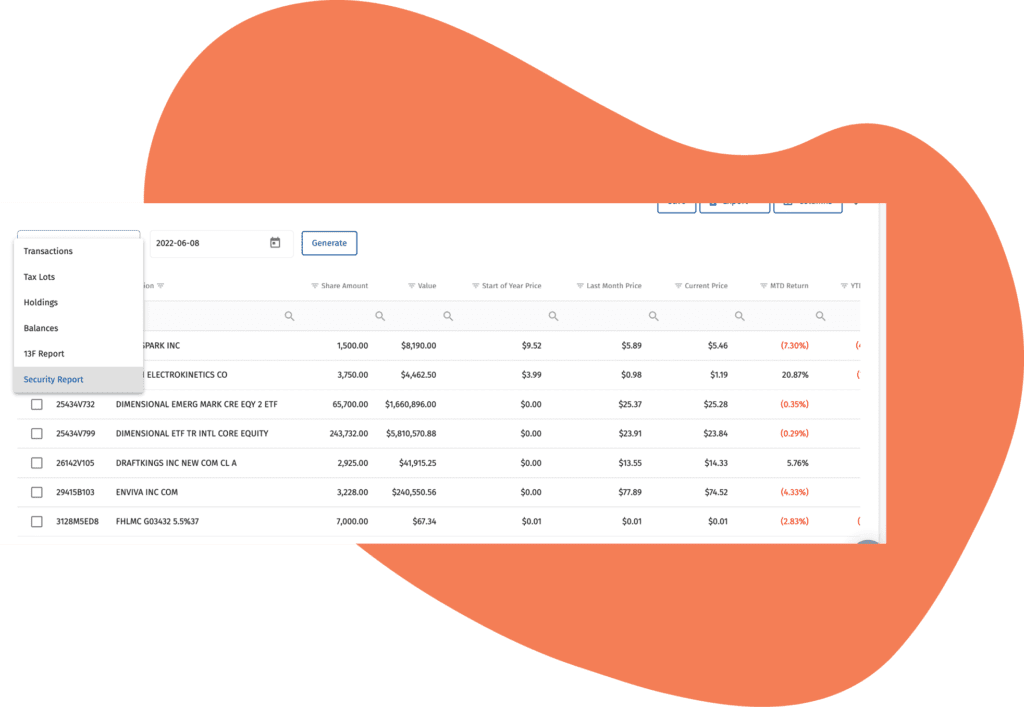

13F Report: No need to sift through old spreadsheets, paper statements, or disparate systems to find the data you need. The 13F Report takes the pain out of filing Form 13F with our new automated tool.

New Security Report: Generate a snapshot report of all securities held across your entire book of business; flexibility to select a specific date or date range.

New Data Management Interface: Atlas’ expanded data management tab will help support manual reconciliation events. For example, Atlas users can now make cost basis updates more quickly.

Manual Account Creation: Changes to the Atlas system make it even easier for advisors to manually create accounts ad hoc.

New Subreport PDF Option: Our reporting tool offers a new built-in subreport new subreport called Allocation and Performance Summary which gives advisors more flexibility to simply and efficiently present the information that matters most to their clients

Client Inbox: The new Client Inbox tool allows advisors to send fully-customized, automated emails to their end-clients on a predetermined schedule.

New Integrations Powered by BridgeFT WealthTech API

Plaid: Our new open banking integration with Plaid creates a permanent, fully-secured link between BridgeFT and banking institutions. This integration eliminates the need for end-users to continuously re-enter their login credentials and allows them to seamlessly pull in held-away assets for more comprehensive reporting and billing. Additionally, it offers a much more secure data transfer of sensitive financial information.

Eaglebrook: BridgeFT’s integration with Eaglebrook gives advisors the ability to report and bill on crypto assets. This integration enables financial advisors, TAMPs, and wealthtech partners to gain a better understanding of their clients’ complete financial picture which now includes digital assets, paving the way for better investment advice and more accurate management, reporting, and billing on crypto positions. Read the press release.

StratiFi: Our one-way integration with StratiFi delivers account-level holdings to StratiFi’s platform, this data then enables StratiFi to provide financial advisors with a real-time risk score for each account. BridgeFT’s WealthTech API delivers consolidated and accurate account information from all of the major RIA custodians directly to StratiFi’s risk management platform, offering a complete picture of an investor’s assets so financial advisors can provide a comprehensive evaluation of every portfolio under management. Read the press release.

Stay tuned for continued product updates! If you’d like to be the first to hear about feature releases, enhancements, and upcoming events, register for our newsletter now.