Alongside portfolio performance, a trust-based, transparent client-advisor relationship is still what investors value most. Technology can’t–and shouldn’t try to–replace the human side of advising. However, when used properly, it can most certainly enhance it–leading to better client outcomes and more successful advisors.

Modern technology affords advisors many advantages including improved efficiency, optimized back-office operations, and a greater capacity to provide custom, on-time financial advice. The ideal is to strike a balance between digital and traditional approaches to manage the client relationship. In this article, we’ll showcase how digital capabilities can empower advisors to provide human advice, meeting clients where they’re at and strengthening their relationship.

Going Remote

In 2020, the COVID-19 outbreak slingshotted many firms into a newly-digital environment. Not only was technology implemented to allow employees to work from home, it was also deployed to help advisors communicate more often and proactively with clients during a period of increased financial anxiety.

Although many firms found challenges in initially transitioning to remote meetings via technology, this trend is likely to continue well into the future. Beyond this, many firms are now attempting to go entirely paperless (something they may have wanted to do all along, but are now pushed to do so with greater urgency). Today’s client demands the flexibility of high-quality virtual meetings backed by secure e-document sharing and electronic signature processing.

Custom Data and Insights

Recent research showed that 53% of respondents reported some level of customization in their communications with their advisor. However, less than four in 10 respondents said the content was “engaging,” and less than three in 10 reported the advice to be “actionable.”

The result of digital transformation across industries is that the “customer experience” has been permanently altered, and investors have come to expect a certain degree of this within their advisor relationship too.

Investors want to interact with their advisors on social channels and want high-quality, engaging and actionable financial advice. Increasingly, investors don’t want to be required to log into a new portal, especially if there are alternative, lower-friction channels on which to engage. Modern advisors must leverage technology to provide more personalized communication and experiences for clients.

Information Available On-Demand, Online

Online customer engagement has become mainstream due to transformation across sectors. More recently, FinTech has jumped in to cater to this demand to make investment advice more accessible. Particularly, emerging investors—the high net-worth clients of the future—are expecting a more modern approach to how they interact with their financial advisor. Younger generations want information available on-demand online and in their Inbox, and will most likely access it via their smartphones. As a modern advisor, it’s important to leverage technology that empowers clients to access real-time data insights online or communicate directly where they already spend their digital time.

Data-Aggregation Powering Financial Advice

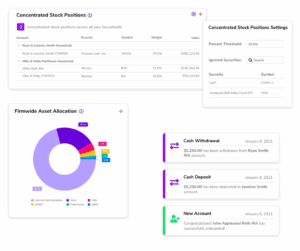

Effectively leveraging data aggregation enables advisors to see a holistic view of their clients’ finances. Beyond this, data aggregation benefits clients through more personalized advice, enabling advisors to develop actionable insights and strengthen client relationships. All of this to say: adoption of data aggregation leads to better client outcomes.

And research backs up this claim — an Aite study, “Technology Integration Turbocharges Advisor Productivity: Making Time for Clients,” revealed that RIAs who utilize data aggregation have 78% larger books of business than those who don’t.

Data-powered investment advice appeals to investors across generations. Clients benefit when their advisor has a seamless, real-time view of accounts and activity. This in turn allows advisors to provide more detailed, specific advice based on client needs.

Real-Time Account Updates

That same Aite study also revealed that 77% of clients prefer to receive updates on their financial information on a weekly basis.

As modern advisors prepare to better serve upcoming investor generations, they need to start thinking about alternatives to hard-copy reports and quarterly in-person meetings, and become early adopters of technology that provides more regular, real-time client insights. It’s crucial for advisors to have the technology in place to showcase performance and important updates to clients in an easy-to-understand, user-friendly format that goes beyond the long-standing paradigm of a PDF report. Advisors need new ways to proactively engage and manage their clients’ accounts, especially as the market pushes advisors to serve more clients with the same resources.

This is exactly why Bridge recently launched our Insights Engine–data-driven technology that analyzes the thousands of data points from an advisor’s client accounts in order to provide them with cutting edge insights on what is going on within client accounts, where to take action, and when to reach out to a client. This technology gives advisors a competitive edge without adding any additional costs or work to their day to day. Insights are delivered in a summarized, easy to digest email and allow advisors to seamlessly update clients, strengthening those relationships over time.

Bridge’s Insights Engine allows advisors to:

- Provide highly personalized, actionable data insights to clients

- Empower advisors with access to real-time insights available online

- Harness the power of data aggregation for holistic client-wide views

- Strengthen client relationships with proactive account management and communications–all without creating any additional work

Click here to learn more about our Insights Engine and get started today.